Our Mortgage and Insurance Services & Costs

The Financial Conduct Authority

The Mortgage Hive Ltd is authorised and regulated by the Financial Conduct Authority (FCA). The FCA regulates financial services in the UK and you can check our authorisation and permitted activities on the Financial Services Register by visiting the FCA’s website www.fca.org.uk/firms/systems-reporting/register. Our Financial Services Register number is 844138

Our Services

For Mortgages we are independent mortgage advisers and we will recommend a mortgage product that is suitable for you following an assessment of your personal needs and circumstances. This will include a detailed assessment of affordability.

We will consider all products and lenders that we have access to. This means we will not consider those lenders that are only available by you going direct to them.

Where you are increasing your borrowing, we will consider the merits of both a new first charge mortgage and securing this by an additional mortgage on a second charge basis. You may have the option of a further advance from your existing lender; however, we will only consider this where we are able to deal directly with the lender on your behalf.

It may be in your best interests to explore this option and look at the further alternative of an unsecured loan, as these may be more appropriate for you.

For Non-investment protection contracts we are an intermediary and will act on your behalf when providing advice and making our personal recommendation(s) to you. We will do this based on a fair and personal analysis of insurers for term assurance, income protection, critical illness.

The Costs of our Service

Mortgages

We will receive and retain a commission from the lender when your mortgage completes. This amount will be confirmed by the lender in their disclosure document. Should you wish you can request to view the commission rates from each of the lenders we have considered at the time that we make our recommendation to you.

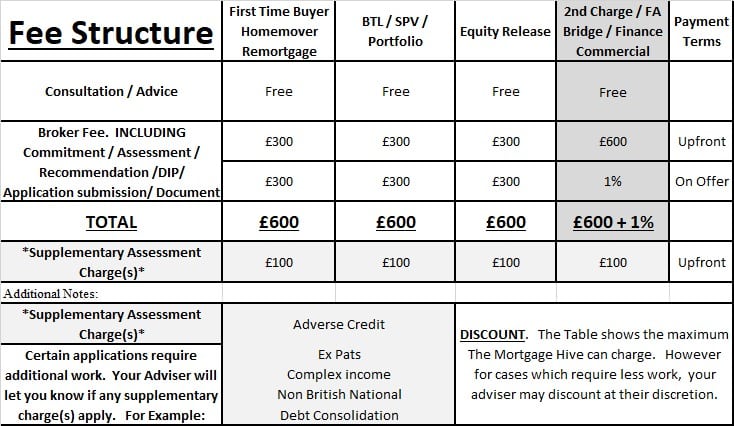

The Fee’s we charge are shown in the image below:

Non-Investment Protection and General Insurance Contracts

We do not charge a fee as we will receive commission from the provider/insurer after the policy has been placed on risk.

Our Ethical Policy

We are committed to providing the highest standard of advice and service possible. The interest of our customers is paramount to us and to achieve this we have designed our systems and procedures to place you at the heart of our business. In doing so, we will:

- be open, honest, and transparent in the way we deal with you.

- not place our interests above yours.

- communicate clearly, promptly and without jargon.

- seek your views and perception of our dealings with you to ensure it meets your expectations or to identify any improvements required.

Cancellation rights

Certain protection and insurance contracts allow you the right to cancel after a contract has been put in force. Prior to you entering into a contract of protection or insurance we will provide you with specific details should this apply to include: its duration; conditions, practical instructions and any costs for exercising it, together with the consequences of not exercising it.

Instructions

We prefer our clients to give us instructions in writing, to aid clarification and avoid future misunderstandings. We will, however, accept oral instructions provided they are confirmed in writing.

Complaints

If you wish to register a complaint, please write to The Mortgage Hive Ltd, 707B Wimborne Road, Bournemouth, Dorset, BH9 2AU or telephone 01202 084064. A summary of our internal complaints handling procedures for the reasonable and prompt handling of complaints is available on request and if you cannot settle your complaint with us, you may be entitled to refer it to the Financial Ombudsman Service at www.financial-ombudsman.org.uk or by contacting them on 0800 023 4 567.

Compensation Scheme

If you make a complaint and we are unable to meet our liabilities, you may be entitled to compensation from the Financial Services Compensation Scheme.

Further information about the limits applicable to the different product types is available from the FSCS at http://www.fscs.org.uk/what-we-cover

Client Verification

We may be required to verify the identity of our clients, to obtain information as to the purpose and nature of the business which we conduct on their behalf, and to ensure that the information we hold is up-to-date. For this purpose, we may use electronic identity verification systems and we may conduct these checks from time to time throughout our relationship, not just at the beginning.

Law

This agreement is governed and shall be construed in accordance with the Law of England and the parties shall submit to the exclusive jurisdiction of the English Courts.

Force Majeure

The Mortgage Hive Ltd shall not be in breach of this Agreement and shall not incur any liability to you if there is any failure to perform its duties due to any circumstances reasonably beyond its control.

Termination

The authority to act on your behalf may be terminated at any time without penalty by either party giving 7 days’ notice in writing to that effect to the other, but without prejudice to the completion of transactions already initiated. Any transactions effected before termination and a due proportion of any period charges for services shall be settled to that date.

DECLARATION

This is our standard agreement upon which we intend to rely. For your own benefit and protection, you should read the terms carefully. The Mortgage Hive will require written confirmation via Letter or Email before proceeding.